DeFi coin is an important term that you must have about a lot in this year. Every person who is interested in investing money and watching the financial markets must be familiar with these terms.

DeFi or decentralized finance is the term that is getting more popular in the world and it is popping up frequently in the finance industry. All of us are observing an amazing change in the demand for investment in relation to cryptocurrency.

The interest of the customers is getting bigger in this industry and DeFi is serving this purpose rightly. This process of investment is quite different from the rest. Unlike other investments, it does not ask for your paperwork and you can easily process your work digitally. The transaction from the bank will come clear and you will not have to take the stress of keeping in touch with the middleman.

Most people are now preferring these Defi tokens because they don’t need any presence of the lawyers to allow you the next move. It also helps in providing you with the best opportunity for increasing the growth of your businesses. These Defi are also helpful in stopping the gap between the people and their financial investments. Banks and hedge funds are equally transmitting their reliability for these new technologies.

The Top 13 Best DeFi Coins for 2021

To make things even easier for you we have made a list of the top 11 best Defi Coins for 2021. These Coins are arranged, compared, and ranked according to their demand. With the increase in the demand for these coins because of their decent work, this family is getting bigger.

We are providing you with a list of the best Defi Coins to make sure that you are choosing the right coins. Their market cap and circulating supply values are also given. You can compare these values to decide which one is the right DeFi token or coin you want to choose for investing.

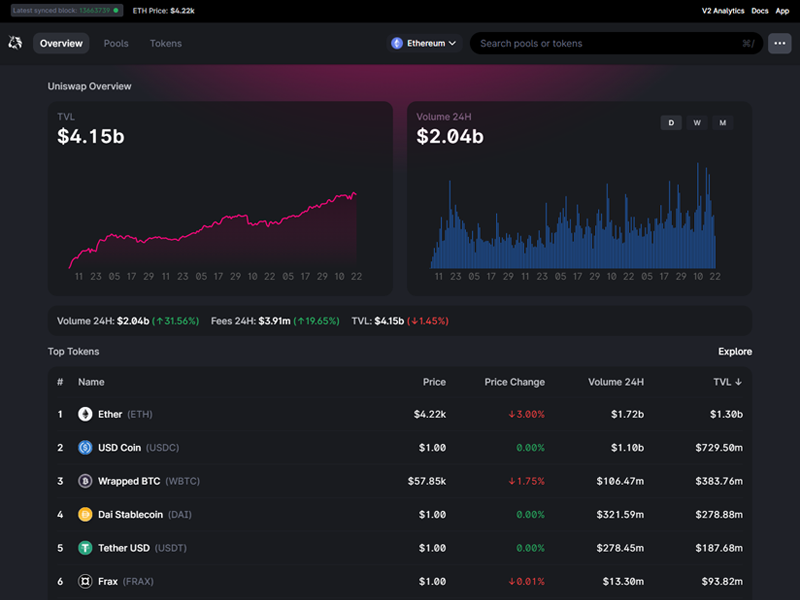

1. Uniswap

It is a popular exchange protocol that is famous for its investment options and the great role that it plays in the automation for the trading of decentralized finance tokens. The best thing about this token is that it launched in November 2018 and has already gained the trust of many users. This helps in increasing the facilitation of the customers by keeping the process of an automation open for anyone who has enough tokens.

It also has the best efficiency against tradition VS traditional exchange. Any liquidity solution is automatically solved by this coin and you will not face any decentralized exchange. Users can easily shape their future when they are using this coin because of the potential, profitability, and reliability of this coin.

Market Cap

The market cap of this coin is $9 billion with a market cap dominance of 0.35%.

Circulating Supply

The total supply of these coins in the market is around 1 billion units in the market. The inflation rate of these coins will become 2 percent in the market shortly. The token distribution of these coins is exemplary and it is distributed widely. 60% of the total income is given to the community members while 21% goes to the team members and 0.69% is given to the advisors. 17.8% is given to the investors and there is a three to four-year schedule for this distribution.

Read More: Best NFT Projects

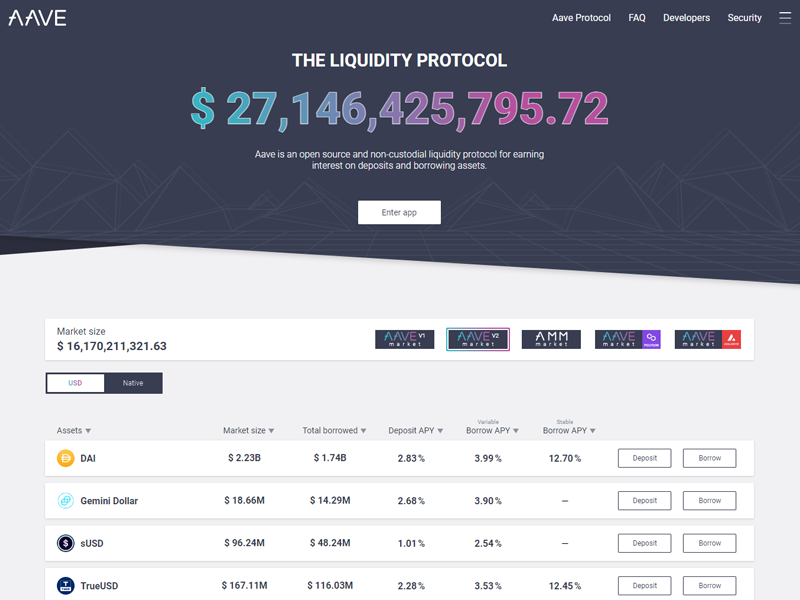

2. Aave

It is an extremely user-friendly decentralized finance protocol that helps people in borrowing and lending crypto. It has a very simple process of working because of the easy automation process. Users who are lenders can easily earn interest by allowing their digital assets to be deposited. These assets are deposited into specific liquidity pools that are created for this purpose.

Now the people on the other end that need to borrow money can use this money as collateral way from the crypto wallet. This platform is also famous for providing amazing discounted fees. It is the best coin for providing the user with the facility to control the development of the pool.

Market Cap

The market cap of this trading tool is 3.587B and the market dominance for this tool is 0.14%.

Circulating Supply

The Circulating Supply of this coin is amazing and it is the total value of the locked coin in the Aave. $16.2 million was raised by selling the one billion units of Aave in the market. 23% of the tokens of Aave are given to the investors. The feasibility of the token swap is also available in this trading pool. This network and its circulating supply are famous because of the foolproof security system available for it. This system is built on the foolproof security system of Ethereum. There are different platforms to buy these coins including CoinBene, Binance, and OKEx.

3. Pancake Swap

It is one of the most popular decentralized trading pools for users in the market. It has become the best coin for trading purposes because of a wide blockchain network. This pool provides an excellent and wide-ranging feature set for the users. With the help of this platform, you can easily use the BNB token and many other varieties of coins as well. The best thing about using this feature is that you will not have to focus on the private keys.

The secure investment and trade on this platform and automation of trade through smart contacts help in an easy transaction. There are no risks for the counterparty as well because all trading is secured with end-to-end encryption. Certik and Slow mist are the famous open-source platforms for increasing the security of trading. The native utility token of the platform is a cake that is now becoming a part of the DeFi coins.

Market Cap

The market cap of this platform is $3 billion. The trading volume of this platform is said to be 0.14 percent.

Circulating Supply

The Circulating supply of this platform is currently $240 million cake coins. The total supply of this coin is reaching infinity in today’s market. Experts and financial professionals are recommending using this coin to gain the most exchange. It has the most active rate for the exchange in the market.

4. Loopring

This tool is one of the most amazing tools when it comes to creating the best trading experience with these coins. It is an open protocol and it is specifically designed for increasing the smooth process of decentralized exchanges of crypto.

This tool has the most amazing system for keeping the funds stored for buying and selling orders. There is the availability of the blockchain networks as well which will take it to the best aspect of both centralized and decentralized exchanges.

It is available for users from 2017 along with all its systems. Inefficiencies are easily removed by the presence of easy depositing and withdrawing purposes. One of the main reasons for the preference of this system is the availability of debugging solutions. All of the fear from potential hackers and related issues are handled on their own because of the foolproof security system.

Market Cap

The market cap of this platform is 3.77B and the available volume available for this tool is considered to be 1.42B.

Circulating Supply

When it comes to the circulating supply of the Loop ring Protocol you don’t have to worry. The issuance is strictly governed by the smart contracts where it mixes and matches the currencies for you. Any nodes on this network are strictly rewarded in the form of LRC tokens.

The circulating supply for this network is considered to be between $1 billion these days. You can easily buy these coins from OKEx and Mandala Exchange.

5. Terra

This is also another amazing tool for the coins that use protocol for blockchain to increase the value of the global coin payment system. This system is currently utilizing fiat-pegged stable coins to show dominance in the market.

There are two elements combined when you are using this platform for your business including wide adoption of currencies and price stability.

You can easily get your hands on the fast and easy settlements when using these tools. The platform is also important for maintaining the protocol for the overall stability of the rates of coins.

Terra has an amazing one-to-one peg algorithm that helps in keeping the demand of the coin stabilized. It has the most famous user base of $45 million and it has a merchandise value of $25 Billion.

Market Cap

The market cap of this platform is $38 billion and the volume of the trading goes up to 0.036 %.

Circulating Supply

There are a total of 1 billion tokens of Terra that are in circulation these days. If the number of tokens is more than this the tool will get burned and it will come to equilibrium once the state is managed. For initial investors, this tool was purchased from the private market only.

When it was first officially made public to the users it gained the sale of at least $32 million. It should also be remembered that the profit for the employees will be 20% and for the Terra Alliance, it will be 20%.

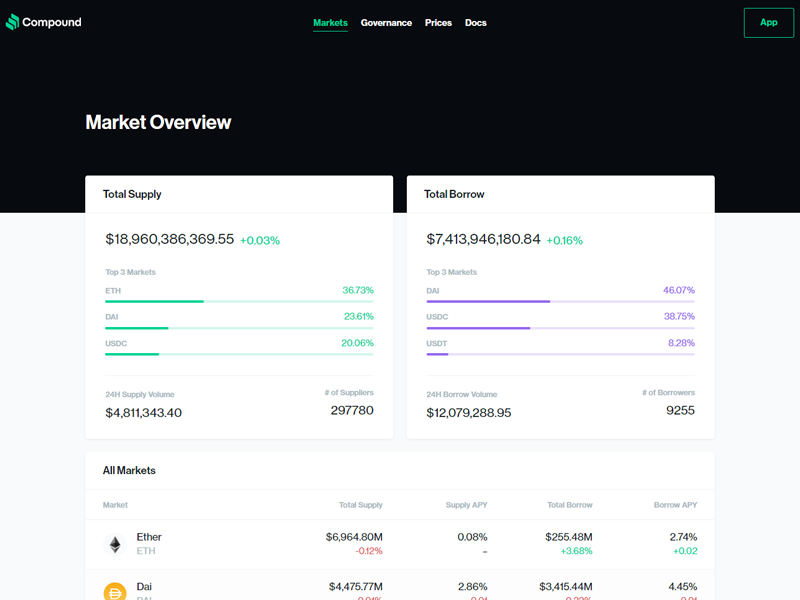

6. Compound

It is the best and efficient pool for trading coins that is helping users in earning interest on their cryptocurrencies. You can use this platform by depositing these coins in only one or several pools to get the maximum money.

This platform is supporting multiple pools and it increases the efficiency of the results. Whenever a user deposits the tokens in the system they receive tokens in return. You can easily choose to redeem the underlying cryptocurrencies from the pool anytime.

By the time the exchange rate for these tokens increases and you will get more money. This will help you in getting your hands at a better asset and you can easily redeem the points. Another amazing thing about using this platform is that you can use a secured loan from this tool as well.

This is a collateral system and it allows the depositing from another side as well. The total locked value of this system currently is $800 million. This tool was founded by Robert Leshner in 2017.

Market Cap

The market cap of this tool is $19 billion and the volume of the market cap is 0.05579.

Circulating Supply

When it comes to the circulation supply of this platform you will be amazed to know that it has a fixed number of tokens for users. A total of $10 million COMP are used to increase the supply of these tokens but only $4 million are circulated among the users.

Everything present on these platforms is protected by the smart contracts that help in keeping the data safe. The safety of collateral levels is maintained and it will be sold to the liquidators. Earning opportunities for the lenders also increase because of these tools.

7. Chainlink

This coin was founded in 2017 and it is getting popular since then for its easy-to-use interface and amazing features. It is one of the most reliable blockchain abstraction networks that is helping its users and enabling them in getting universally connected through smart contracts.

Chainlink works on the principle of a decentralized oracle network and keeps your coins safe for you. It allows blockchains for making it easier for the users to securely interact with multiple data feeds, events, and payment methods.

This tool and its structure are driven by the most trusted providers and the largest open-source community of data providers. There are multiple smart contract developers, node operators, genius researchers, security auditors, and more. It is also playing a significant role in providing critical off-chain information. This information is often much needed by complex smart contracts because it helps them in getting the dominant form of digital agreement.

The tool emphasizes making sure that decentralized participation is perfect and secured for all the users and beginners looking to contribute to the network.

Market Cap

The market cap of this platform is $13 billion and the market dominance is 0.51%.

Circulating Supply

Chain Link is working with a total and maximum supply of 1,000,000,000 LINK tokens currently in the market. The current supply according to the research made in September was about 453,509,553 LINK tokens. This equals 45% of the total supply of these tokens in the market. Around mid-2019 to mid-2020 the prices went down because of the mess and burns created by the excessive use. T

he price of Chain Link is $0.11 and a total of 350 million LINK tokens were thought to be sold once it was made public for the users. In the market, the bulls of this tool were colloquially referred to as “LINK Marines. This, later on, became a well-known meme in the crypto community.

When it comes to the distribution of the rewards, the ICO documentation divides 35% of the total token supply towards node operators. A part of it also delivered to the incentivization of the ecosystem.

Another 35% of LINK tokens were given generously during public sale events price of this reliable platform reached an exceptionally high of $52.88 in 2021. It was the peak of the back of an overall crypto market rally. It happened because of the ongoing developments in the Chainlink ecosystem.

The remaining 30% of the total token supply is the best part of the company for the continued development of the Chainlink ecosystem and network.

8. Cardano (ADA)

Cardano was formed in 2017 and it was made public to all the users for getting the best benefits for crypto-currencies. Cardano is famous for its proof-of-stake blockchain services. Experts love it because of the freedom to use this tool. The goal of this platform is to give all the change-makers, visionaries, and innovators to invest their money for a safe positive investment.

The developers of this blockchain have created this tool to give users an easy-to-use platform for maintaining all the transactions.

Financial experts are often recommending this tool to beginners to manage all of their transactions carefully. The ADA token is perfectly designed to make sure that users can comfortably participate in the operations of the network. It also plays a significant role in assisting those who are using the cryptocurrency wallet and are concerned about security issues. The infrastructure of this token is amazing as it has the most amazing layered blockchains.

These blockchains are compelling and they have been using the best technology for making them more secure. It also brings credibility to the use of decentralized apps and smart contracts. The safety protocols used in this app are the best and you can easily rely on it for safe transactions.

Market Cap

The marketing cap of this tool is 62.6 Billion and the volume of trading is around 1.63 Billion.

Circulating Supply

When we looked into the market we came to know that there are about 45 billion tokens for ADA. As far as the amount Circulating in the market is considered you can see about 31 billion tokens.

The circulation showed that these tokens were given almost 5 times for the public sales of Cardano tokens. These public sales were held between September 2015 and January 2017.

The price of the tokens during its pre-launch sale was about $0.0024, which shows that there was an increase in the price for over 1000x return. The profit of almost 2.5 billion ADA was given to the main resources once the network launched.

For investors and founders, a total amount of 84% and 16% of ADA’s total supply were given. The amount of 2.1 billion ADA was given to Emurgo which is a famous global blockchain technology industry.

This company is serving as a foundation unit of the Cardano protocol. Another important fact about this token is that the amount of 648 million ADA was given to the not-for-profit Cardano Foundation. This is an amazing company that is providing help and aiming for the promotion of the platform. It has also the basic focus on increasing the levels of adoption.

9. Avalanche

Avalanche is an excellent layer of one blockchain with the best function and foolproof security. This platform is famous for its decentralized applications. It also gives its users the best option for custom blockchain networks to protect them from hackers. Avalanche has a unique architecture and it has the most famous DeFi coins interface. It does not affect your scalability as well.

There are three types of blockchains present in these chains including X-Chain, C-Chain, and P-Chain. This tool is considered to be the rival of Ethereum. This is because the results of the infrastructure of this tool are aiming to unseat Ethereum. It wants to replace it with the most popular blockchain.

This popularity is shared for the smart contracts and it wants to get that. You can also use this tool to get your hands on higher transactions.

The chains of the tool have a distinct purpose and it helps in the use of multiple Bitcoin and Ethereum use. This platform is important for continuously updating itself and working on developing its ecosystem.

Multiple Ethereum-based projects including Sushi Swap and True USD are now integrated with Avalanche. They are named so because all nodes are important for transactions. Avalanche blockchains even use different consensus mechanisms based on their use cases.

Market Cap

The marketing cap of this tool is $26 billion and the volume of trading is 1.64 billion.

Circulating Supply

The total supply of AVAX in the market is 720 million. Its token distribution is 2.5% -for the seed sales. 10% profit is spent on the release of mainnet launch and the rest is spent every 3 months after the release. For a private sale, it spends a profit of 3.5 percent. It also makes sure to circulate the supply for public sale events.

You can observe a sale of 10% release for the mainnet launch. A reward of 10% is also given to the team and the company workers. This tool has the highest staking rewards of 50%.

10. Polkadot

This platform is famous in the crypto market as an open-source sharding multichain system with protocols. It is helping in facilitating the cross-chain data transfer and assets. It assists in seeking the best ways to create a fully decentralized and private web.

This web is created and further controlled by its users to facilitate them. Polkadot also simplifies the creation of new applications and programs.

The whole availability is not just limited to tokens and this is why it is famous in the eyes of experts. It allows a wide range of running the blockchains interoperable with each other. Polkadot’s native DOT token is serving three main purposes of its platform efficiently. These three programs include providing the best network governance and operations. It also has the most efficient tools available for creating parachains (parallel chains).

The Polkadot platform helps in connecting the public and private chains. It also gives permissionless networks, oracles and future technologies access to make secure transactions. The presence of these independent blockchains helps in sharing information and transactions through this server and its reliable chains.

Market Cap

This platform has a market cap of $41 billion.

Circulating Supply

There are total allocations of 1 billion DOT tokens for this platform in the market. These tokens are available for the users and it increases the facilitation of the users. Research showed that this network was used for redenomination. And it served an initial awesome supply of 10 million in August 2020. The redenomination was almost undertaken purely to avoid any mishaps.

It was also done so to make it easy for the users to make the most use of small decimals and make the calculation easier. Most of the balances were increased by a factor of one hundred when these were used and it did not impact the distribution of DOT or holders’ proportional share.

In October 2017, Polkadot’s first initial coin offering (ICO) was managed. The Polkadot price was $0.29 and a total of 2.24 million tokens were offered. The second event was held in July 2020 and increases in the prices were observed. The price of Polkadot where every token reached the price of upto$1.25. A total of 342,080 DOT tokens were sold at that time.

11. DAI

This platform has an excellent Ethereum-based stable coin system for the proper issuance and development of cryptocurrencies. These protocols are managed by the Maker Protocol with the best security systems.

The rates of this trading pool DAI are soft-pegged to the U.S. dollars. These are mostly collateralized and the cryptocurrencies are deposited into the various smart-contract wallets.

You can also check them under the name of MakerDAO decentralized autonomous organization. It also gave an important differentiating system between Multi-Collateral DAI and Single-Collateral DAI (SAI).

This is an earlier version of the coin in the form of a token that could only be collateralized by one cryptocurrency unit. For SAI you have to remember that it doesn’t support the DAI Savings Rate. This allows the users to earn savings by holding DAI tokens.

Market Cap

The marketing cap of this platform is $65 billion.

Circulating Supply

There are a total of $240 million circulating tokens for these items. These tokens are not produced via mining just like Bitcoin (BTC) and Ethereum (ETH). These are also not circulated in the market as some coins are minted by a private company.

These DAI tokens are easily circulated by any user via the use of Maker Protocol. This Maker Protocol ensures that every DAI token is protected by an appropriate amount of other cryptocurrencies. For this process the protocol allows the users to put their crypto into a so-called wallet.

12. Sushi Swap

Sushi Swap is also known as Sushi in the market. It is the best example of an automated market maker and it is loved by experts. The popularity of this platform is increasing among cryptocurrency users. These are the most amazing decentralized exchanges that work on the principle of smart contracts.

You can easily use these tokens to create markets or provide liquidity for any multiple or single pair of tokens. This tool was launched in September 2020. The purpose of this platform is to increase the diversity of the AMM market. It also adds additional features which were not previously present on Uniswap.

Market Cap

The market cap of this platform is $112billions.

Circulating Supply

There are multiple tokens present per block for these items. The first 100,000 blocks of this platform had a block reward of 1,000 SUSHI. The supply of these tokens is dependent on the block rate.

These tokens usually circulate at the rate of 6,500 per day. This means that there are 650,000 tokens of platforms. Research has shown that there are almost 326 million tokens in circulation.

13. Wrapped Bitcoin

This Wrapped Bitcoin is a famous tool for the circulation of cryptocurrencies. It is a better token version of Bitcoin (BTC) and it is running on the principle of Ethereum (ETH) blockchain. It allows the users to be fully integrated into the ecosystem of decentralized exchanges.

There are different crypto lending services and prediction markets that are relying on these coins. This platform was authorized for the users in 2018 but it was officially made accessible to users in January 2019. Bitcoin is also backing up this platform at a 1:1 ratio. This network is automatically monitored by the merchants and owners.

Market Cap

The market cap has a market value of $16 billion and a marketing dominance of 0.53%.

Circulating Supply

This platform is a bit different from the rest. This WBTC is known to be automatically minted or burned. Every time users purchase their tokens they do it via a system of merchants. The total number of tokens circulated in the market is around 94000.

What is a DeFi coin?

For all those who want to know what a DeFi coin is, we are here to help you with this coin. It is technically a digital version of a flat coin that you have seen in your daily life. When you are making a financial transaction these coins add the value of these transactions.

These coins are built on their specific values and each coin has a specific market value and blockchain. Some of the most famous DeFi coins are mentioned above and they include Marker, compound, Aave, Chain Link, and Ankr. These coins have further extensions in the form of DeFi tokens as well but these tokens are a bit different.

Is DeFi coins a good investment?

The best thing about these DeFi coins is that you will not be taking any stress from involving any lawyers or middlemen. Investing in these DeFi projects is risky because not all of them are secure and stable. Please educate yourself about this technology before invest your money.

It is a very easy process to start and you can easily set it up with your crypto wallet. As soon as you have selected the crypto wallet, you are good to go.

The wallet is the way where you will be storing all your money and they come in all formats. Make sure you are selecting the ones that have the integration with the DeFi coins and you will be able to easily make the transactions. After this step, you have to purchase your DeFi Coins and participate in the pool of your choice.

What are the best DeFi coins to buy now?

The best platform for investing your money is to buy Terra, Cardano or Uniswap coins. These coins have the best marketing cap and they have a good circulating supply. Their value in the market has never hit a low and it always increases the value of your investments. If you want to buy these DeFi coins you can check the OKEx market or Binance.

Conclusion

There are multiple types of DeFi options in the market for 2021. The ones that are gaining the most popular include Terra Luna, Wrapped Bitcoin, ADA, and SushiSwap and Uniswap. You can easily choose the one that suits you according to your needs.

The post 13 Best DeFi Coins for 2021 (Compared and Ranked) appeared first on Codeless.

![[Joomla] How to remove or hide Fields marked with an asterisk (*) are required](https://4.bp.blogspot.com/-O3EpVMWcoKw/WxY6-6I4--I/AAAAAAAAB2s/KzC0FqUQtkMdw7VzT6oOR_8vbZO6EJc-ACK4BGAYYCw/w680/nth.png)

![[Joomla] How to remove or hide Fields marked with an asterisk (*) are required](https://4.bp.blogspot.com/-O3EpVMWcoKw/WxY6-6I4--I/AAAAAAAAB2s/KzC0FqUQtkMdw7VzT6oOR_8vbZO6EJc-ACK4BGAYYCw/w100/nth.png)

0 Commentaires